Table of Contents

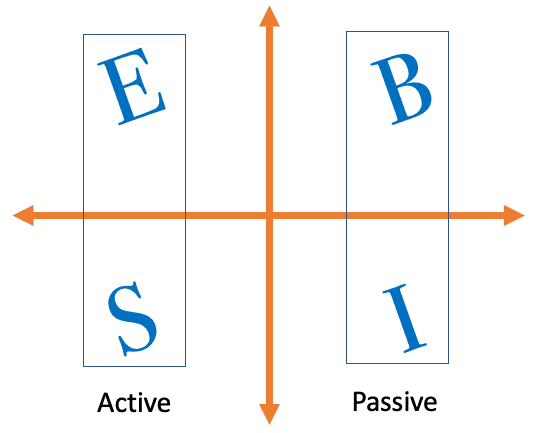

The Cashflow Quadrant represents the different methods to generate income or money. Your income stream or income level is not necessarily linked to your level of education. There is no doubt that higher education can give you an early advantage but it’s not responsible for your final destination in terms of finance.

Many successful people have left school without receiving a college degree—people such as Thomas Edison, founder of General Electric; Henry Ford, founder of Ford Motor Co.; Bill Gates, founder of Microsoft; Ted Turner, founder of CNN; Michael Dell, founder of Dell Computers; Steve Jobs, founder of Apple Computer; and Ralph Lauren, founder of Polo. A college education is important for traditional professions, but not for how these people found great wealth. They developed their own successful businesses.

What Is the Cashflow Quadrant

E (Employee): You exchange your time and effort for an income. If you don’t work, you will not get income.

S (Self-employed or Small Business): You work for yourself, but can you take a 6-week holiday and your business keeps on working without you?

B (Big Business): These group people have peoples working hard for them to generate them an income

I (Investor): They are the people that have money working hard for them. Play golf and enjoy a good life.

E & S cashflow quadrants are mainly active sources of income. Without your own involvement, you cannot generate money. But the majority of the people belong to these two quadrants. These people take a minimum or no risk and security is their prime focus. It’s mainly job or regular paycheck security, which holds them back. They know if they are jobless for a few months, life will be too hard as they will not be able to pay various EMIs, children’s fees, etc. They are surrounded by so many securities, that most of them cannot even think beyond their routine job. This is the main reason that these groups remain in these quadrants for life long and even pass an almost similar legacy to their next generation.

The other two cashflow quadrants i.e. B & I are mainly passive sources of income. People in these quadrants enjoy freedom by leverage the power of other people and money to work for them. These people achieve financial freedom in the fastest way possible. If their one business is established, they hop for another business. They enjoy leisure time and make their best investments decisions. These quadrant people also pass an almost similar legacy to their next generation.

“I would rather earn 1% off a 100 people’s efforts than 100% of my own efforts.”- John D. Rockefeller

Which Quadrant is Your Source of Income?

The cashflow quadrant represents the different methods to generate income or money. For example, an employee earns money by holding a job and working for a person or a company. Self-employed people earn money working for themselves. A business owner owns a business that generates money, and investors earn money from their various investments—in other words, money generating more money.

People have income sources from one quadrant or multiple quadrants at a time. For employees at an early stage for their career, it starts with E, and then progressively there are E & I quadrants. For Self-employed people at the early stage, it’s S, and then progressively there area S & I quadrants and possibly can I as well. And for Big business group people it’s mainly B & I. And for the Investor group, it’s mainly I & B.

Each quadrant of income generation requires different frames of mind, different technical skills, and different educational paths. While money is all the same, the way it’s earned can be vastly different. If you begin to look at the four different labels for each quadrant, you might want to ask yourself, “Which quadrant do I generate the majority of my income from?”

One Can Earn Income in All Four Quadrants

Most of us have the potential to generate income from all four quadrants. Which quadrant you or I choose to earn our primary income from is not so much dependent upon what we learned in school. It’s more about who we are at the core—our beliefs, values, strengths, weaknesses, and interests.

Regardless of what type of work we perform, we can still work in all four quadrants. Like for an engineer following can be the cases-

| Quadrants | As an Engineer |

| E | Join the staff of any private or government organization. |

| S | Open a consulting firm in his or her specialized field or start making products in a workshop with very limited manpower. |

| B | Start a business, employing several people. Establishing it and then leveraging it. |

| I | Become an investor in someone else’s business or in vehicles like the stock market, bond market, and real estate. |

The important words are “generate income from.” It’s not so much what we do, but more how we generate income.

Different Methods of Income Generation

More than anything, it’s the internal differences of our core beliefs, values, strengths, weaknesses, and interests that affect which quadrant we decide to generate our income from. Some people love being employees, while others hate it. Some people love owning companies but don’t want to run them. Others love owning companies and also love running them. Some people love investing, while others can’t get past the risk of losing money. Most of us are a little of each of these characters. Being successful in the four quadrants often means redirecting some internal core values and resetting limiting beliefs.

It is important to note that you can be rich or poor in all four quadrants. There are people who earn millions and people who go bankrupt in each of the quadrants. Being in one quadrant or another does not necessarily guarantee financial success.

Decide Your Own Quadrant

By knowing the different features of each quadrant, you’ll have a better idea as to which quadrant, or quadrants, might be best for you. It’s is not where you have started from, the important is where you are destined to.

If you want to achieve financial freedom, then it’s always advisable to join the group of quadrant B & I people.

As stated earlier, there is no guarantee for financial security in any of the quadrants, then why should not we try for the right side of the quadrants instead of the left side of the quadrants. For most people working on the left side of the quadrant, there are few legal tax breaks available. But by working to generate income on the right side of the quadrants, one can acquire money faster and keep that money working for oneself longer without losing large chunks of it in the form of taxes. (Excerpt From ‘Rich Dad’s CASHFLOW Quadrant’ by Robert T. Kiyosaki)