Table of Contents

Debt trap! Is it not a fearful word? We live a financial life in which we are just a few weeks or a few months away from being broke. There are several examples like If we don’t get the next business deal, if we lose our job, if we miss the next endorsement contract as a celebrity we are going to be broke.

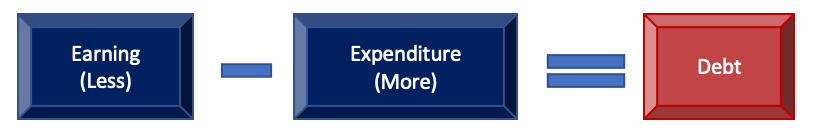

We focus on earning but in parallel, our expenditures also increase. When our expenditure is more than the income, what is the outcome; to borrow from someone to fill the gap e.g. if your monthly income is Rs. 30,000 and expenditure for the month is Rs. 35,000, then you need to borrow the differential amount of Rs. 5,000 to manage the things.

We manage this situation for a few months, then this pattern becomes a part of our subconscious mind i.e. the mind registers one pattern of financial deficit and all the emotions associated with it. As the subconscious mind is neutral, it doesn’t understand positive emotion or negative emotion. Anyway when we are in debt, can we have positive emotions, hardly; most of the time we have negative emotions.

Now, this is something interesting, suppose in one particular month your earnings are more than your expenditures and you are having surplus money. In this situation, your subconscious mind will suggest you something like buying additional stuff, or some mean to spend your surplus or even more than surplus.

Why does it do so? Because it wants to give you the same feeling which you are experiencing every month. It’s true, how many times we fall into the trap of credit card buying. We buy something using a credit card, why are we using a credit card, to earn points or we are not having money in our account but we want that particular thing immediately.

We get extra time to pay on credit card purchases. If the amount is more then we prefer to convert that amount in EMI or at the time of purchase only we ask the seller to convert our credit card purchase into EMI.

If you do this once or twice, there is a good chance that when you are near to your last payment of EMI, some other thing will pop up to purchase in a similar pattern and other EMI will start e.g. we buy big-screen TV from discounted sell on the credit card.

EMI Trap Continue!

Now in the last two EMI payments, there might be a demand for a new fridge or mobile or holiday package which is also with additional advantage if we buy through a credit card.

As we are not able to pay the full amount on the due date (in the world more than 70 % of people don’t pay credit card payments on the due date), then we ask to convert that purchase to EMI. So the EMI trap continues.

Here no means, I am saying that we should not buy things on a credit card, what I am saying that we should not fall into the trap on EMIs as it hardly ends.

We become habitual of this trap and many a time pay hefty interest charges in-between while conversion of purchase in EMI or not paying the full amount on the due date.

Debt & Your Life Time!

People do not realize that they spend more than 50% of their lifetime to pay the debt. If you bought Rs. 30,000 TV by borrowing money and if your net income is also Rs.30000, then logically you have booked 26 days (Working days in the month) x 08 hours (Working hours per day)=208 hours of your life for this TV payment.

Again, I am no mean saying that you should not buy a TV, what I am saying is that buy when you have money with a cash or a debit card. We must focus on our earnings and constantly improve the means. But we become Red-Faced child, who need the toy (things) right now, so we do better deals but with a credit card and become happy with earned points on that purchase.

We are so much used to listen to people around us and also from banks that we cannot even imagine buying a Rs 30,000 component with Cash. When we buy items in cash, we can ask for a good discount.

Time and again one thing is coming out that we get a reflection of what we keep in our mind most of the time. If all the time dept is there, we shall get the situations to support this thought as this is controlled by your beliefs and your subconscious mind.

Own Painful Experience of Debt

I have personally gone through this pain for more than one year. Short of some amount almost every month then I borrowed money from my friends or relatives. Then I changed this cycle after applying principles from one book on the subject. As I was only one month away from debt-free life, so I changed my thought process. I had managed for one month, then for the complete year and till now.

One thing I realised during my transition is that most people are not having financial knowledge and really don’t want to discuss those financial matters with anyone. So from where wisdom comes to rescue us unless otherwise, we have financially smart friends/relatives from whom we can learn or read good literature on this subject. If we train our mind to take good care while dealing with finance, it does. Whatever we focus on, It expands, so does it happen in our financial condition also.

Way ahead Discipline (Investment)!

Many a time earning amount is not important, more important is discipline to spend the money in a more logical way, investing it regularly. Preferring investing over spending i.e. when we receive our salary, payment investment should have priority over spending. Once we set an investment pattern, our mind supports our every movement. Remember, at this time don’t keep the fear of losing in mind all the time, if this thought sinks in your subconscious mind, there is a good chance that you will lose your money. So always have wealth/money abundance thoughts.

“A scarcity mindset can cause you to limit yourself through your beliefs and actions, preventing you from achieving your biggest goals, keeping you in debt, or destroying your confidence.”- Anonymous