Table of Contents

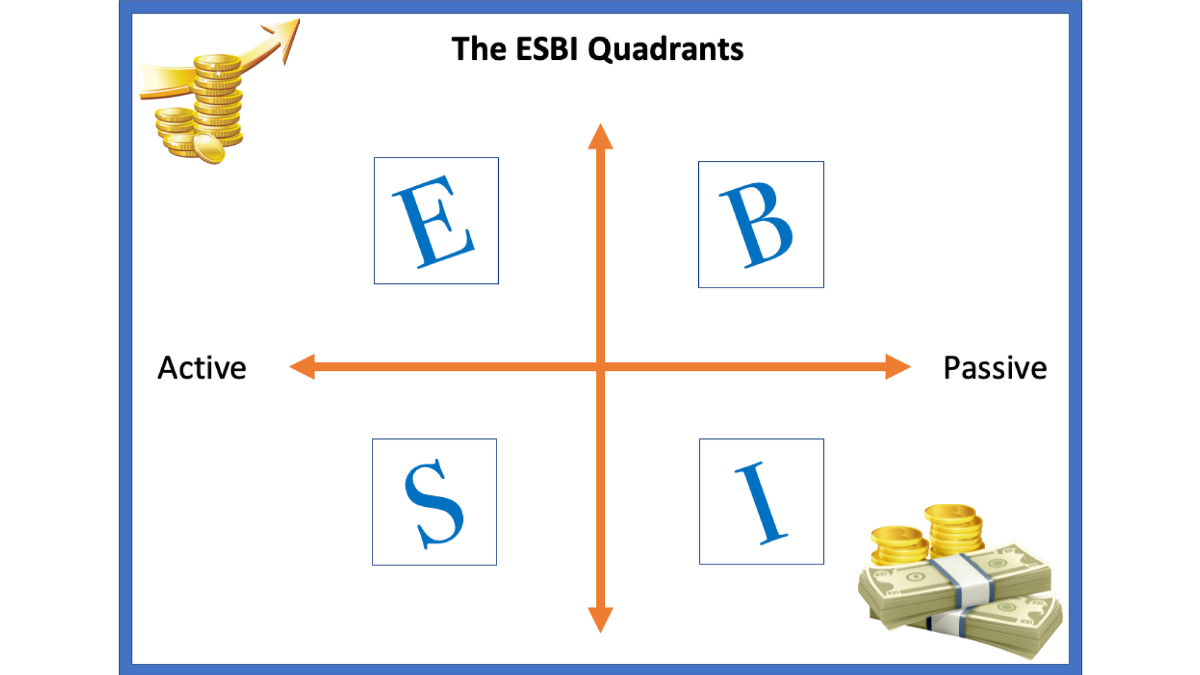

In the pursuit of financial freedom, understanding the principles outlined in the ESBI quadrants can be transformative. Created by renowned financial educator Robert Kiyosaki, the ESBI quadrants categorize individuals based on their primary source of income and mindset towards money. In this blog, we will delve into the essence of each quadrant, emphasizing the significance of transitioning from the left side (E and S) to the right side (B and I) to achieve enduring financial independence.

“In the ESBI quadrants, the key to lasting financial freedom lies in the ability to transition from earning a living to designing a life.” – Robert Kiyosaki

The Employee (E) Quadrant

The E quadrant represents the world of traditional employment. In this quadrant, individuals work for employers or organizations, receiving a regular paycheck in exchange for their time and labour. Here are some key aspects to consider:

Pros of Being an Employee:

- Stability: Employment typically offers a stable income and job security. Employees often have fixed working hours and know what to expect in terms of their paychecks.

- Benefits: Many employers provide benefits such as health insurance, retirement plans, and paid time off.

- Limited Risk: Employees generally don’t bear the financial risks associated with running a business. They can focus on their assigned tasks without worrying about the overall health of the company.

Cons of Being an Employee:

- Income Limits: Employees have a ceiling on their income, primarily determined by their job title, experience, and promotions. They may not have control over substantial income growth.

- Lack of Control: Employees have limited control over their work schedule, tasks, and financial decisions. Their work life is often structured by their employer’s policies.

- Dependency: Job security can be an illusion. Employees are dependent on their employers, and job loss can lead to financial instability.

Understanding the mindset of employees is crucial. Many employees have been conditioned to prioritize job security over financial independence. To achieve financial freedom within this quadrant, individuals must consider strategies like saving, investing, and potentially acquiring new skills or income sources outside of their employment.

The Self-Employed (S) Quadrant

The S quadrant represents individuals who are self-employed or own small businesses. Here are the key characteristics and considerations:

Pros of Being Self-Employed:

- Autonomy: Self-employed individuals have the freedom to make their own decisions and set their work schedules. They are their own bosses.

- Potential for Higher Income: Self-employment offers the potential for higher income compared to traditional employment, especially when their business is successful.

- Ownership: Small business owners have the opportunity to build and own their enterprises, potentially creating valuable assets.

Cons of Being Self-Employed:

- Long Working Hours: Self-employed individuals often work longer hours, especially in the early stages of their businesses. They might have to wear multiple hats and take on various responsibilities.

- Limited Scalability: Many small businesses have limited scalability due to resource constraints and their reliance on the owner’s efforts.

- Financial Risk: Self-employed individuals bear the financial risks of their businesses. They are responsible for expenses, income fluctuations, and potential losses.

Transitioning from the Employee (E) quadrant to the Self-Employed (S) quadrant can be a step towards greater financial independence. However, individuals must be prepared to face the challenges and uncertainties of self-employment. Strategies for success in the S quadrant often involve effective business planning, marketing, and continuous learning to adapt to changing market conditions.

The Big Business (B) Quadrant

The B quadrant is where big business owners reside. These individuals have successfully built enterprises that operate independently, allowing them to enjoy significant scalability and financial potential. Key aspects of the B quadrant include:

- Leadership: Big business owners must exhibit strong leadership qualities. They set the vision for the company, inspire employees, and make strategic decisions that drive the business forward. Effective leadership is crucial for creating a motivated workforce and a positive organizational culture.

- Delegation: Delegation is a fundamental skill in the B quadrant. Successful business owners delegate tasks to capable team members, allowing them to focus on high-level strategies and decisions. Delegating effectively not only lightens the owner’s workload but also empowers employees and fosters a sense of ownership and responsibility within the organization.

- Effective Business Management: Business management in the B quadrant involves overseeing complex operations, financial management, marketing strategies, and more. Owners must possess a deep understanding of various aspects of their business, ensuring efficiency and profitability. Implementing effective management systems and processes is vital for sustained growth and success.

- Sustainable Business Model: Building a sustainable business model is paramount in the B quadrant. This involves creating systems and processes that can adapt to market changes, technological advancements, and evolving consumer preferences. A sustainable business model ensures long-term viability, allowing the business to thrive even in challenging economic climates.

The Investor (I) Quadrant

The I quadrant represents investors who generate income through investments in assets such as stocks, real estate, and other ventures. Investors in this quadrant focus on building and managing a diversified portfolio to generate passive income. Key aspects of the I quadrant include:

- Power of Passive Income: Unlike active income earned through employment or self-employment, passive income earned in the I quadrant allows investors to earn money with minimal effort. This passive income stream can come from dividends, rental properties, interest, or capital gains. Passive income provides financial stability and freedom, allowing individuals to pursue their passions and interests without worrying about daily financial pressures.

- Investment Strategies: Investors in the I quadrant employ various investment strategies to grow their wealth. These strategies include value investing, dividend investing, real estate investing, and more. Each strategy comes with its own set of risks and rewards, and successful investors diversify their investments to minimize risks while maximizing returns.

- Risk Management Techniques: Managing risks is crucial for investors. Diversification, thorough research, and understanding market trends are essential risk management techniques. Investors assess their risk tolerance and invest accordingly, balancing high-risk, high-reward investments with more stable, conservative options to create a well-rounded portfolio.

- Building Wealth Over Time: Wealth-building in the I quadrant is a gradual process that requires patience and discipline. Investors focus on long-term goals, allowing their investments to compound over time. By reinvesting earnings and staying informed about market trends, investors can steadily build their wealth and achieve financial goals such as retirement, funding their children’s education, or leaving a legacy for future generations.

Transitioning Between Quadrants

Transitioning between the quadrants is a pivotal step towards achieving financial freedom. This process involves a deliberate shift in mindset, skills, and financial strategies.

- Acquiring New Skills: Moving from the E and S quadrants to the B and I quadrants often requires acquiring new skills. This could mean pursuing further education, gaining certifications, or developing technical skills relevant to the business or investment world. Learning about finance, marketing, management, and investment strategies equips individuals with the knowledge they need to thrive in the B and I quadrants.

- Building Passive Income Streams: One of the fundamental differences between the left (E and S) and right (B and I) sides of the quadrant is the nature of income. Passive income, which comes from investments and business systems that do not require constant active involvement, is a key characteristic of the B and I quadrants. Exploring avenues such as real estate investments, dividend-paying stocks, online businesses, or royalties from creative work can help individuals build sustainable passive income streams over time.

- Cultivating an Entrepreneurial Mindset: Shifting from an employee or self-employed mindset to an entrepreneurial mindset is crucial. This mindset involves embracing opportunities, taking calculated risks, being innovative, and thinking long-term. Entrepreneurs in the B quadrant, for example, focus on creating systems and leveraging the efforts of others to generate income. Developing resilience, adaptability, and a willingness to learn from failures are also integral aspects of an entrepreneurial mindset.

Overcoming Common Challenges

- Financial Education: One of the primary challenges faced by individuals is a lack of financial education. Many people do not have a clear understanding of investments, taxes, and financial planning. With comprehensive financial education, including budgeting, investing, and understanding different financial instruments, one can be empowered to make informed decisions.

- Mindset Shifts: Shifting from a scarcity mindset to an abundance mindset is essential. Overcoming limiting beliefs about money and success, developing confidence, and embracing a positive attitude towards wealth creation are crucial mindset shifts. Techniques such as visualization, affirmations, and mindfulness can aid in this transformation.

- Embracing Calculated Risks: Fear of failure often holds people back from taking risks. However, calculated risks are inherent in the entrepreneurial journey. Understanding the difference between reckless risks and well-thought-out risks, along with developing risk management strategies, can help individuals navigate challenges and setbacks effectively.

Overall, understanding the ESBI quadrants is more than a financial philosophy; it is a roadmap to financial liberation. By recognizing the strengths and limitations of each quadrant and actively working towards transitioning to the B and I quadrants, individuals can break free from the shackles of financial insecurity. Armed with knowledge, determination, and a strategic mindset, anyone can embark on the journey towards unlocking lasting financial freedom.